The pandemic changed the U.S. labor market. Here’s how.

July 08, 2025

It’s been five years since Covid-19 lockdowns brought parts of the U.S. economy to a halt. While the crisis has passed, its impact on the labor market, especially wages, is still unfolding.

In February 2020, the U.S. economy was enjoying a Goldilocks moment. Unemployment was 3.5 percent, hiring was steady, and wages were rising modestly faster than inflation.

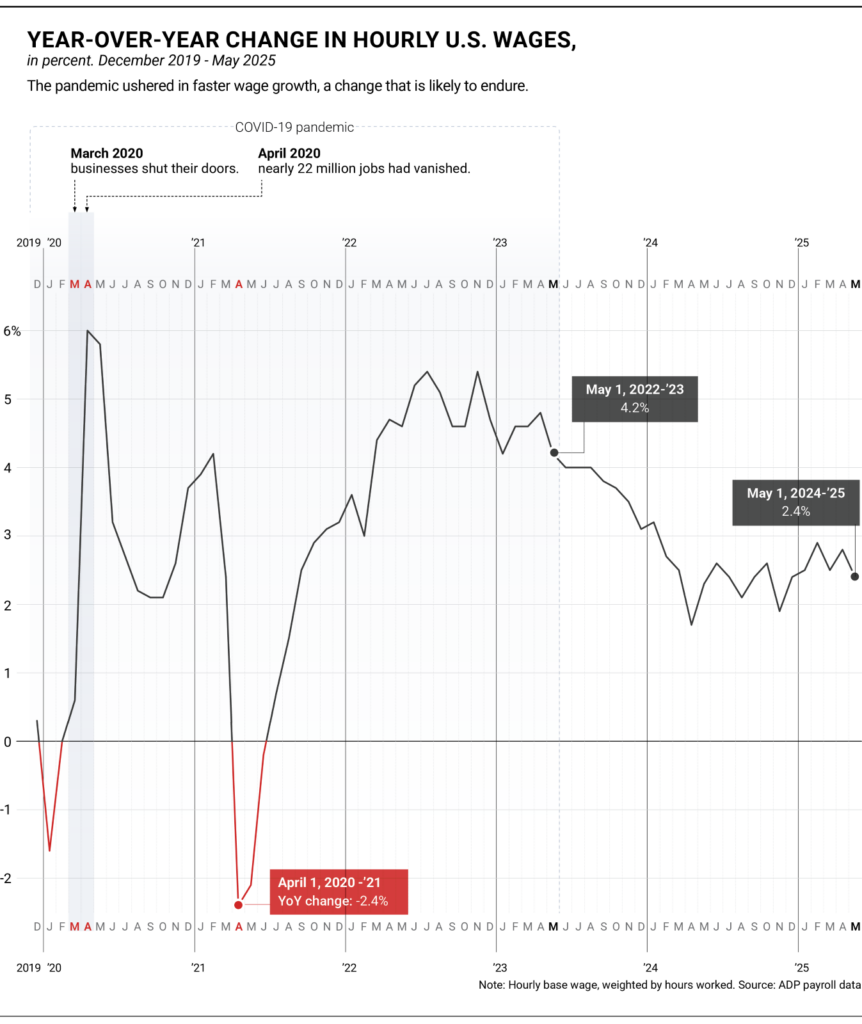

That moment came to a screeching halt in March 2020 when businesses shut their doors in the fight against the virus. By April, nearly 22 million jobs had vanished.

The job loss was short-lived. As consumers adapted and lockdowns lifted, companies began hiring aggressively. By spring 2021, the number of available jobs exceeded the number of available workers, especially in hard-hit customer-facing sectors such as leisure and hospitality.

Now, wage growth has shifted into higher gear in what could be a permanent fixture of the post-pandemic economy. In our latest issue of Today at Work, Jeff Nezaj, Liv Wang, and I show how the boom-and-bust drama of the pandemic is still being felt.

Average wages rise

As the pandemic set in, U.S. wages jumped sharply. Between March and April 2020, private-sector hourly earnings climbed from $31.05 to $32.75 an hour, an increase of nearly 5.5 percent. No, employers weren’t handing out raises. The increase was caused by a change in the composition of the work force. As employers cut lower-paid employees, average pay rose.

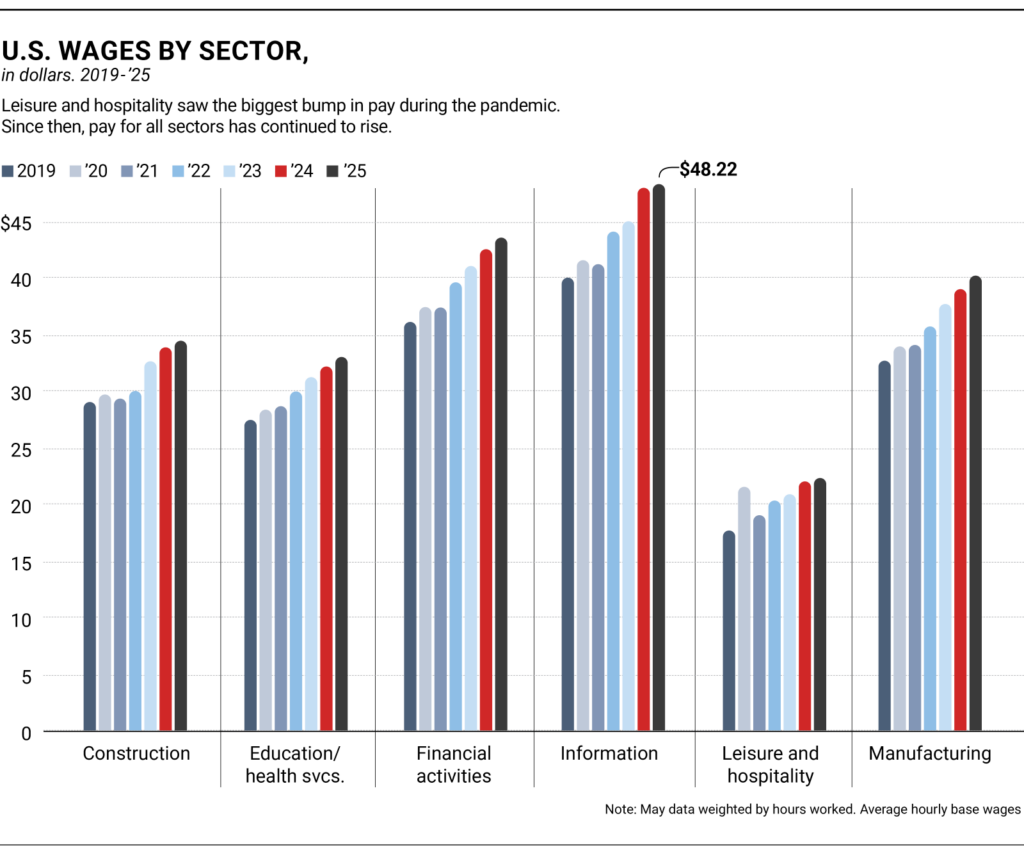

This effect was especially pronounced in leisure and hospitality. Between May 2019 and May 2020, employment in the sector fell 17 percent, then continued to contract for another 12 months. As these lower-wage jobs disappeared, average hourly pay in the sector jumped 21.8 percent, an increase of $3.85. Because leisure and hospitality typically pays lower wages on average—just $17.68 an hour—the sector’s shrinking footprint had an outsized impact, lifting overall U.S. wages.

Average wages fall

The pandemic’s job losses were short-lived as U.S. employers scrambled to rehire in the face of rapidly changing economic conditions. Between May 2020 and May 2021, the return of lower-paid workers led to a decline in average wages in several sectors.

Employers weren’t cutting pay en masse. Rather, as we saw in the early months of the pandemic, the composition of the employed population changed. As employers rushed to fill lower-paying jobs, average wages fell.

Nowhere was this more evident than in leisure and hospitality, where average hourly pay fell 11.6 percent to $19.03.

This decline was far and away the biggest of any sector. Construction (-1.2 percent), information (-0.9 percent), natural resources and mining (-1.1 percent), other services (-3.0 percent), professional business services (-1.2 percent), and trade, transportation, and utilities (-1.5 percent) also saw year-over-year declines in pay.

Just as the loss of low-wage jobs in 2020 had pushed average wages higher, their return brought those averages down, from $32.66 to $31.98 an hour.

Leisure and hospitality workers see gains

Before and during the start of the pandemic, wage growth for leisure and hospitality workers lagged that of other sectors. Between November 2018 and November 2019, job-changers in the sector saw just a 5 percent increase, compared to 14 percent in construction, 10.9 percent in financial activities, and 10.3 percent in professional business services.

Between November 2019 and November 2020, pay for leisure and hospitality workers shrank 1.1 percent.

That all changed as the economy reopened. Between November 2020 and November 2021, pay for job-changers in leisure and hospitality surged 15.2 percent. The following year brought another double-digit gain of 11.1 percent.

As the labor market stabilized, the sector’s wage growth cooled. The year-over-year increase slowed to 4.7 percent in 2023 and 3.6 percent in 2024.

The labor market grows older, then younger

The pandemic didn’t just alter pay. It affected workforce demographics.

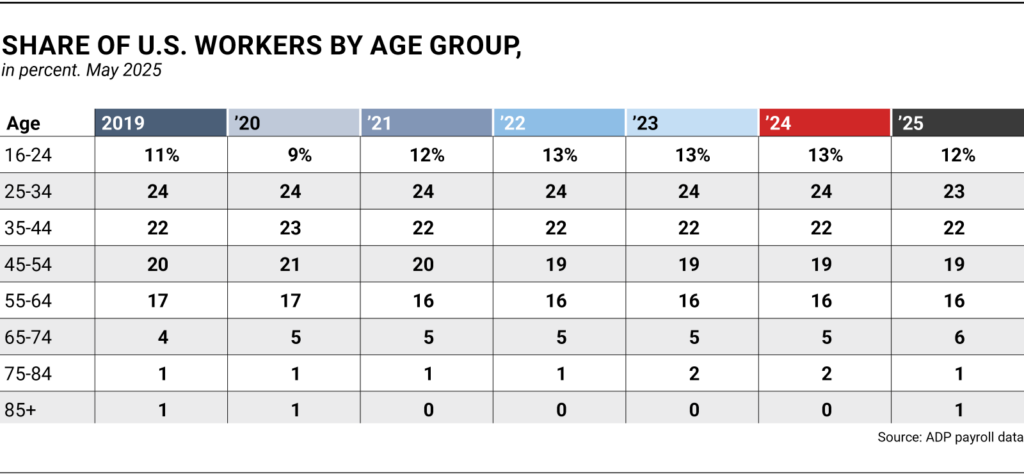

The share of U.S. workers aged 16 to 24 shrank from 11.7 percent to 9.6 percent between May 2019 and May 2020 as young workers exited the workforce. Other age groups held steady or saw small gains.

Because young workers tend to earn less than older workers, their absence at the outset of the pandemic likely contributed to the rise in average wages. And because many of them work in leisure and hospitality, their departure compounded the sector’s strong wage gains.

As lockdowns eased and job opportunities returned, young workers returned. By 2023, young people were back, making up 13.2 percent of the U.S. workforce, a larger share than before the pandemic. Their reentry put downward pressure on average wages. As of 2025, workers aged 16-24, are 12 percent of the workforce, a percentage point greater than before the pandemic. The share of workers over 45 has held steady at 42 percent for the past three years, 2 percent lower than the share before the pandemic.

Our take

The Covid-19 pandemic shocked the labor market, but it also became a catalyst for change. From temporary disruptions to lasting shifts in worker expectations and employer strategies, today’s labor market is, in many ways, new.

In the second half of 2022 and 2023, average wage growth retreated from its post-pandemic highs. And between June 2024 and May 2025, average wage growth was 2.5 percent. Compare that to the -0.2 percent average for the four months prior to the pandemic. The reversal from flat pay or negative growth to a more robust 2.5 percent as of May 2025 marks just how far the labor market has changed over the last five years.

Robust wage growth likely is here to stay. A shrinking labor supply, persistent labor shortages in some sectors, and a rapidly aging work force will keep wage growth from slowing to pre-pandemic levels.

Jeff Nezaj and Liv Wang contributed to this report.