The big deal about small employers

June 10, 2025

Last week, ADP data showed that employers with fewer than 50 workers shed a large number of jobs—13,000—in May. While one month doesn’t make a trend, it does remind us of the big role small employers play in our economy.

When it comes to the macroeconomy, what’s the big deal with small employers? Here are three reasons small businesses have an outsized impact on the U.S. labor market.

Employment is bigger

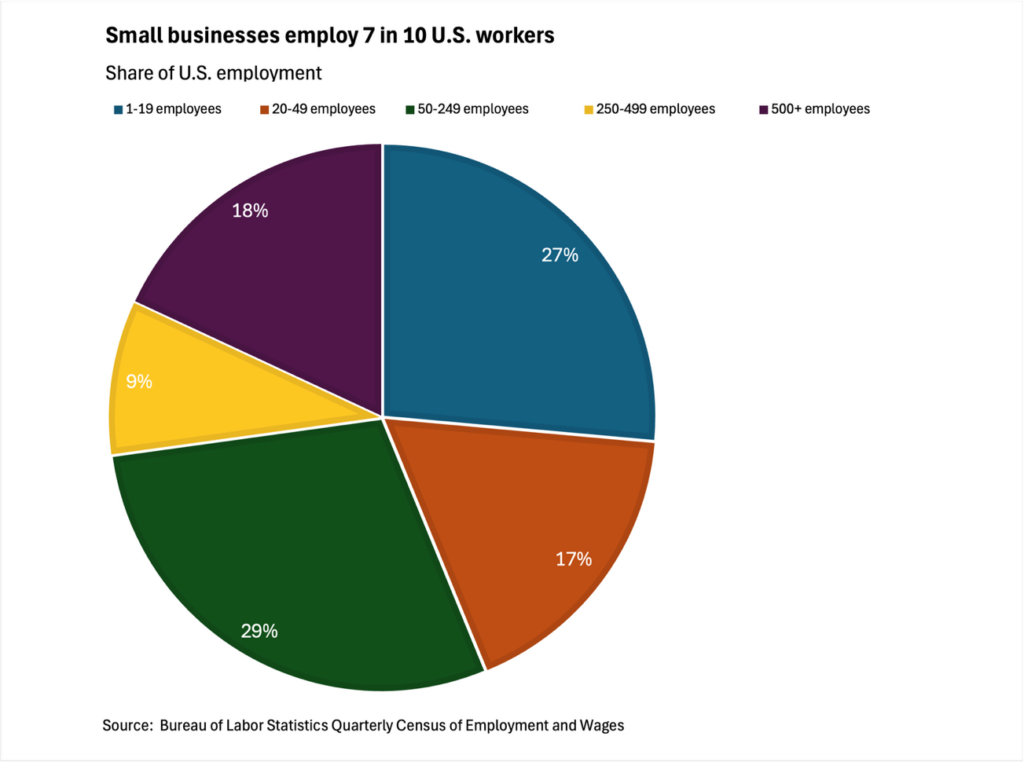

The definition varies, but a good rule of thumb is that any business with fewer than 250 employees is small.

According to the Quarterly Census of Employment and Wages, a near-perfect tally of U.S. employment from the Bureau of Labor Statistics, businesses with between 1 and 249 workers employ nearly 73 percent of workers in the United States. More than 40 percent of workers are employed at businesses with fewer than 50 employees.

Pay is lower

Small employers also set the pace for wage growth, a key input into labor costs and the pace of inflation.

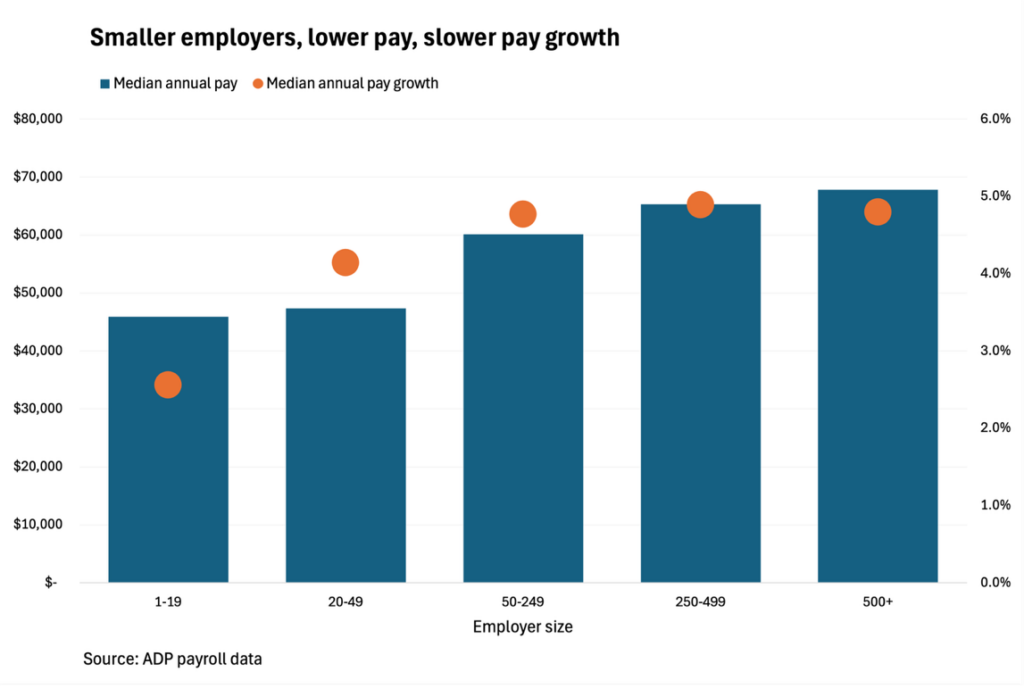

For the typical worker, the smaller the employer, the lower the pay. The median worker at the smallest businesses, those with fewer than 20 employees, makes about $21,000 less than the median worker at companies with 500 or more employees.

The reasons behind this small-versus-large employer pay gap are varied and can include variables such as industry concentration and location.

When we look at a matched sample of workers—people working at the same employer in May 2024 and May 2025—we see that not only is pay lower, median pay growth at small employers lags that at larger ones.

In May, pay at the smallest employers rose 2.6 percent year over year. At businesses with 250 and more employees, year-over-year pay was up more than 4.8 percent.

Wages and pay play a key role in inflation. In normal economic times, smaller employers have the effect of dampening pay growth, while larger ones tend to accelerate it.

Fewer people leave

Despite lower pay and slower pay growth, small businesses come out on top when it comes to employee retention.

When we looked at April turnover—the number of workers who left an employer in April as a share of that employer’s headcount in March due to quits, layoffs or firings—we found that small businesses have more stable head count than larger ones.

In 2025, the monthly 2.5 percentage gap between small firm and large firm turnover has been at the highest level we’ve seen since we started tracking this data in 2017.

My take

Small businesses are scrappy and resilient by design. Their agility and ingenuity help them compete with larger employers for talent, despite the typically lower pay.

They also have been able to hang on to employees despite this year’s macroeconomic uncertainty. And there are other advantages of small businesses when it comes to promotions and career progression.

Despite their small size, small businesses are a big deal. Hence, as go small employers, so goes the labor market. May’s job losses aren’t cause for alarm, but they deserve our attention as the economy continues into uncharted territory.

The week ahead

Tuesday: We get a read on how small businesses are feeling about the economy when the National Federation of Independent Businesses releases its Small Business Optimism Index. The usually resilient index has trailed its 50-year-plus historical average for two months.

Wednesday: In April, the Consumer Price Index rose just 2.3 percent from a year ago, the increase since February 2021. Economists will be watching May data for any sign of upward pressure on inflation that might be caused by tariffs.

Thursday: Unlike the Consumer Price Index, the Producer Price Index doesn’t include import prices. For that reason, economists will be watching to see if these two measures of inflation start to diverge.

Jobless claims have become a calming influence on market watchers worried about job losses. But there are signs that the soothing power of claims is starting to weaken after two weeks of moderate increases.

Friday: There’s been a lot of uncertainty in the economic outlook for 2025, but it’s been pretty clear where consumers stand: They’re bummed. The University of Michigan’s Consumer Sentiment Survey in May hit its lowest level since July 2022, when inflation was nearly 9 percent. We get a new read on Friday.

ICYMI: “The Age of Work”, a collaboration between ADP Research and American Public Media’s Marketplace, continues this week with a visit to the youngest labor market in the United States.