Pay trends to watch in 2026

February 17, 2026

Last week, I presented five noteworthy facts about the National Employment Report. This week let’s turn to the subject of wages and ADP’s Pay Insights data, which tracks the year-over-year pay change for individual workers each month. Through the lens of more than 26 million monthly private sector paychecks, we capture five key wage indicators shaping the labor market.

Here are the trends to watch for 2026, in five easy charts.

The pay premium for changing jobs has narrowed

My team taps anonymized, high-frequency payroll data to track the same cohort of workers over 12-month intervals to compute each individual’s year-over-year change in gross pay, including base salary, bonuses and tips. This matching process results in more than 15 million pay-change observations each month.

From these observations, we calculate the median year-over-year pay change for job-stayers, workers who are with same employer that they were with a year earlier, and job-changers, people who switched jobs during that 12-month period.

In January, year-over-year pay growth for job-stayers was little changed at 4.5 percent. For the past 10 months, annualized pay growth for job-stayers has stabilized in a narrow range between 4.4 percent and 4.5 percent.

Pay growth for job-changers is more sensitive to real-time labor market conditions. For this group, annualized gains slowed to 6.4 percent in January from 6.6 percent in December. January’s increase tied with November 2025 as the slowest pace of pay growth for job-changers since February 2021.

Moreover, the pay premium for switching jobs—that is, the difference in pay gains between job-changers and job stayers—is the smallest we’ve recorded in data going back to 2020.

The pay premium for switching jobs varies by sector

In January, workers in construction and mining landed the biggest pay bumps from switching employers. For construction, workers who changed employers saw a 6.6 percent pay premium over the sector’s job-stayers; for natural resources and mining, the job-changer pay premium was 5.6 percent.

In the service sector, financial services delivered the biggest return from job-switching. At the other end of the spectrum was leisure and hospitality, where workers were better off staying put than changing jobs.

People are working less than they used to

On average, employees are working an hour less each week than they did before the pandemic. Although January showed a modest year-over-year increase in hours worked, levels remained near a seven-year low.

More people are working part time

In recent years, a larger share of U.S. workers is putting in less than a full work week of 35 hours, ADP data shows. In 2025 and 2026, the share of people working part-time was about 45 percent, 6 percentage points more than in 2019.

Pay for new hires jumped in January

While many of us were digging out of the snow in January, a long-running pay freeze for new hires was thawing. We define new hires as people who joined an employer in the past three months. For a year and a half, median base pay for these recent recruits was stuck at about $18 an hour.

That changed last month, when pay for new hires rose to $19 an hour. This increase was led by accelerated hiring in the higher-paying construction and financial sectors.

An uptick in new-hire pay is the first sign that the labor market’s low-hire, low-fire standoff might be breaking in the right direction toward more job churn and better pay in 2026.

THE NER Pulse

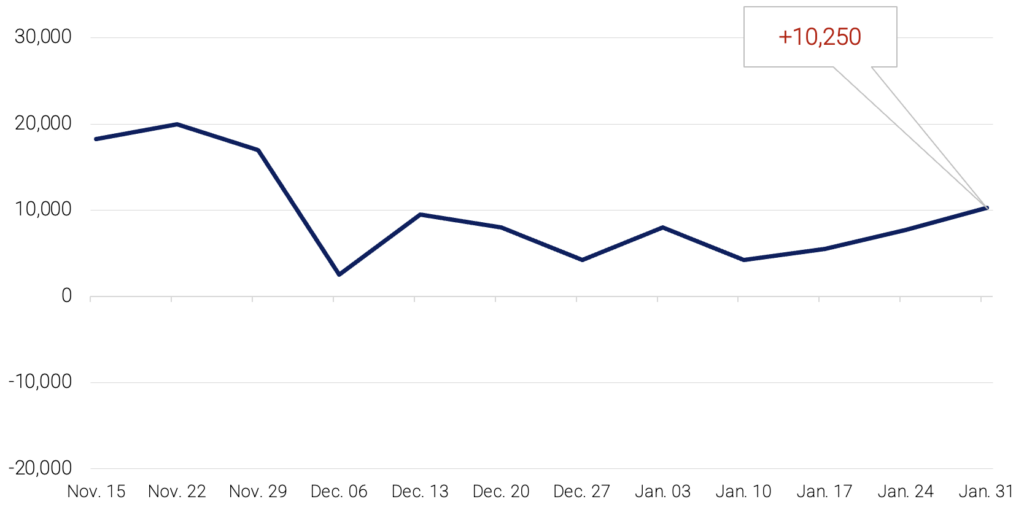

For the four weeks ending January 31, 2026, private employers added an average of 10,250 jobs a week. It was the third-straight week of strengthening job gains.

These numbers are preliminary and could change as new data is added.

About The NER Pulse

Three times a month, Main Street Macro releases the NER Pulse, an estimate of the week-over-week change in employment based on a four-week moving average. These releases are seasonally adjusted and have a two-week lag to allow for more complete and accurate estimates of real-time employment trends. At the beginning of each month, we publish the National Employment Report, which is built on a reference week that includes the 12th day of the month. We do not publish the NER Pulse during NER release weeks.

Download this week’s NER Pulse data

The week ahead

Tuesday: Mortgage rates are at three-year lows, which could bode well for the NAHB/Wells Fargo Housing Market Index, a survey of single-family homebuilders due out this morning. At noon, ADP Research will release the February EMC Index, our monthly tracker of employee sentiment.

Wednesday: Residential construction has been decelerating for the past three years. On Wednesday, delayed November and December data from the Census Bureau will reveal the direction of housing starts going into 2026. Census also will release December data on durable goods. An increase would be a good sign for employment in the goods sector. Finally, meeting minutes from Federal Reserve policymakers will shed light on their recent interest rate decision.

Thursday: The steady and historically low pace of initial jobless claims means it’s been easy for people to keep jobs. In January, people also found it easier to find new ones. February unemployment data from the Department of Labor will tell us if last week’s uptick continuing claims were a one-off or the beginning of a trend.

Friday: Recent reports suggest that we’ll get a solid fourth-quarter GDP report from the Bureau of Economic Analysis today. And with the Consumer Price Index slowing in February, economists expect today’s Personal Consumption Expenditures Price Index, the Fed’s preferred measure of inflation, to slow, too. We also receive data on December new home sales from Census and a first look at February consumer sentiment from the University of Michigan.