Job growth is sluggish, but new hires are on the upswing. How?

November 18, 2025

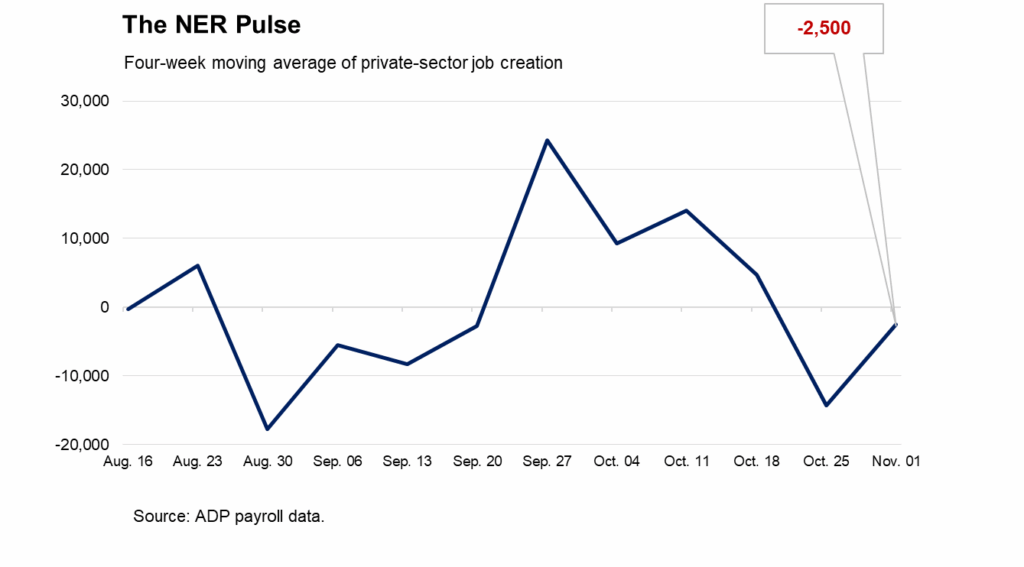

The NER Pulse

For the four weeks ending Nov. 1, 2025, private employers shed an average of 2,500 jobs a week as employment losses slowed heading into November. These numbers are preliminary and could change as new data is added.

Download NER Pulse data.

Three times a month, Main Street Macro releases the NER Pulse, an estimate of the week-over-week change in employment based on a four-week moving average. These releases are seasonally adjusted and have a two-week lag to allow for more complete and accurate estimates of real-time employment trends. At the beginning of each month, we publish the National Employment Report, which is built on a reference week that includes the 12th day of the month. We do not publish the NER Pulse during NER release weeks.

Job growth is sluggish, but new hires are on the upswing. How?

Hiring has slowed from earlier in the year, so one would think that new hires—which we define as workers added to an employer’s payroll in the last three months—would be a shrinking share of the workforce. Instead, they’re on the upswing. What gives?

In October, new hires accounted for 4.4 percent of all employees, ADP payroll data shows, up from 3.9 percent a year ago. This growing share of new hires would seem to run counter to the slowed pace of hiring. That contradiction tells us a lot about today’s job market.

New hires typically fluctuate with the business cycle, but the aging U.S. workforce means that demographics have begun playing a bigger role in hiring decisions. Employers are hiring to replace existing workers, not increase headcount.

Here are three interesting insights into the new hire trend.

New hires are a larger share of employment

In 2019, before the pandemic, new hires accounted for 3.9 percent of employment. This share peaked in 2021 as employers added workers at a rapid clip to fill jobs that had been wiped away temporarily by the pandemic shutdown.

As of October 2025, the share of new hires stood at 4.4 percent, larger than the previous two Octobers, even though job growth was stronger in 2023 and 2024.

One explanation is that the number of people employed or looking for work has been shrinking over the last few years, suggesting that people are leaving the workforce at a faster clip. Labor force participation was 63.3 percent in 2019, but only 62.2 percent by August of 2025, the most recent month of available data.

This suggests that the share of new hires has grown as a result of employers replacing retiring and departing workers, and it’s a trend that’s likely to stick.

The Bureau of Labor Statistics projects that employment will grow much more slowly over the next decade, by just 3.1 percent compared to the 13 percent growth we experienced over the previous decade.

Hiring stalwarts are losing their momentum

Some industries, such as professional business services, a group that includes lawyers, scientists, and accountants, but also lower-paid administrative workers, have higher turnover. Likewise, jobs that require less-specialized skills tend to be easier to get—and easier for workers to discard—so turnover in these sectors also is high. Certain other industries, such as construction, tend to have a smaller share of new hires.

In 2025, the share of new hires has shifted downward in customer-facing sectors. New hire shares in education and health care and leisure and hospitality have contracted by more than a percentage point from a year ago, a big change when compared to other sectors.

These two sectors also have consistently added jobs over the last year, which means their new hire share has fallen even as they’re hiring more people. This suggests that, unlike other industries, workers in customer-facing jobs such as teaching, nursing, hotels, and restaurants are staying put. This might account for the outsized ability of these industries to produce consistent job gains.

New hire pay is stalling

While the share of new hires has fluctuated, pay has held steady. Annual gross pay for this group grew by just 1.7 percent year over year in October, a downshift from the October 2024 pace of 2.8%. And median hourly pay hasn’t budged for 16 consecutive months, holding steady at $18 an hour.

In seven of the 10 super sectors we track, year-over-year gains in annual gross pay have been flat or negative, and information has experienced a big drop in pay.

My take

Employers are taking on a bigger share of new hires, even amid a slowdown in job creation. This suggests that more workers are heading for the exits.

Demographic data also suggests that the drop in new hires isn’t due to normal business cycle dynamics. Thirty-six percent of U.S. workers are 55 or older. In 2015, less than 25 percent of U.S. workers were that old.

This change has put employers on a new footing. Increasingly, hiring is no longer driven primarily by customer demand and economic fluctuations, but by a need to replace a growing number of departing workers.

The week ahead

Government data releases resume this week. Expect data gaps in releases for the period affected by the shutdown.

Tuesday: At noon, ADP Research releases the November Employee Motivation and Commitment Index, which tracks how people think and feel about their jobs.

Wednesday: The Census Bureau is scheduled to release data on housing stats for October. The annualized pace of starts clocked in at 1.31 million in August, down 6 percent from a year earlier. Housing permits, an early signal of future activity, were down 11.1 percent.

Thursday: The Bureau of Labor Statistics will release its September employment report. The bureau’s last non-farm payrolls report showed that the economy added 22,000 jobs in August, a slowdown from the previous month. Weekly initial jobless claims data also resumes this week.

The National Association of Realtors will release existing home sales for October. September sales were up 4.1 percent year over year, and prices rose 2.1 percent.