Boomerang hiring makes a comeback

May 20, 2025

The 2025 job market has been remarkably steady. Initial jobless claims are near historical lows, the unemployment rate is hovering just above 4 percent, and fewer people are quitting their jobs than before the pandemic.

The U.S. workforce is largely staying put, but one set of employees is on the move, and they’re returning to their previous employers.

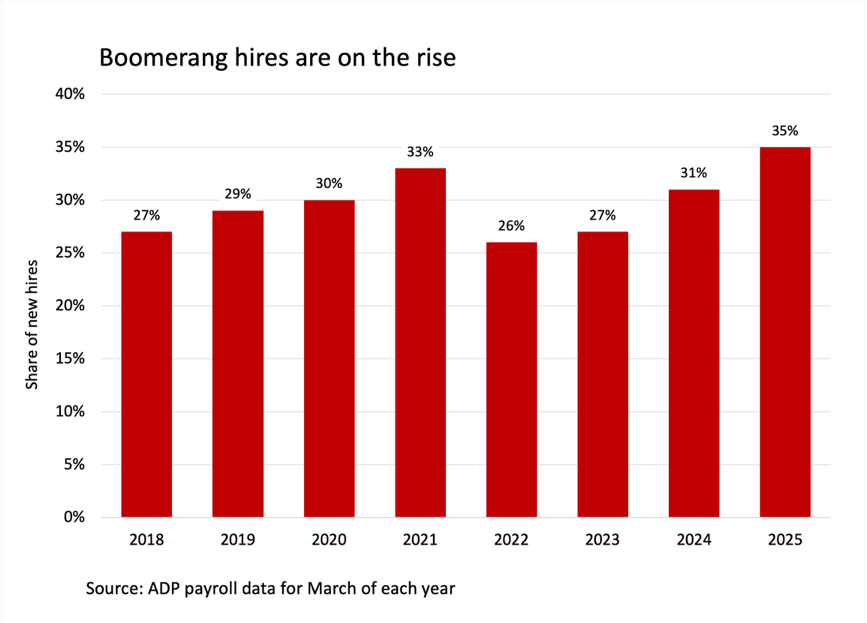

These boomerang hires—people who once were active on an employer’s payroll, went inactive, then returned—make up only 2 percent of all active employees going back to 2018. But they account for 31 percent of new hires on average, ADP payroll data shows.

And in March, boomerang employees made up 35 percent of new hires, up from 31 percent a year earlier.

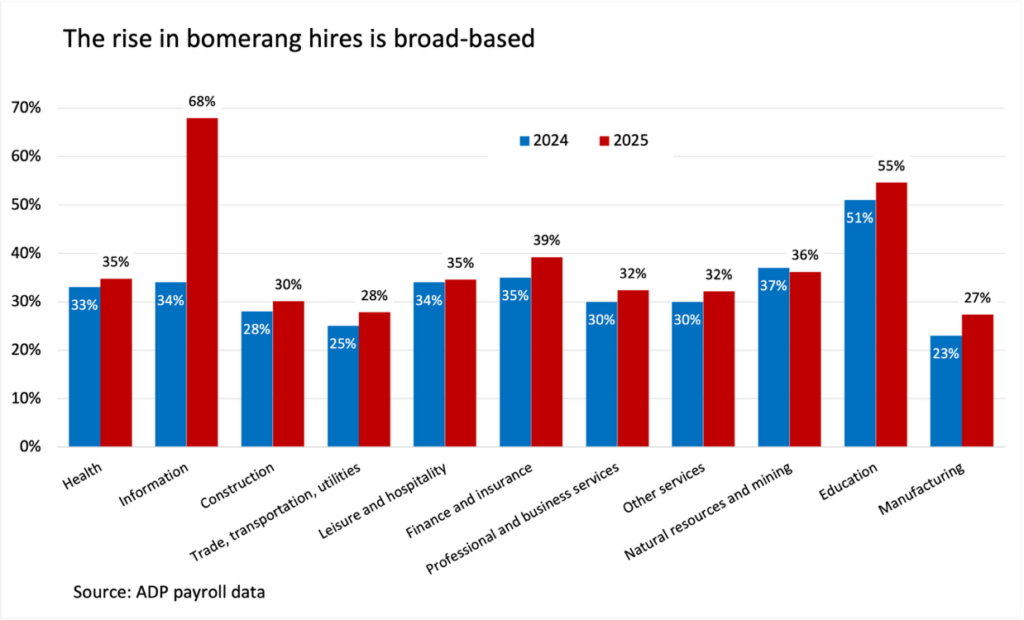

This increase was broad-based, but the information sector stood apart.

In March 2025, nearly two-thirds of new information hires were returning employees, a two-fold increase from a year earlier. Boomerang hires in information have averaged 45 percent in the last 12 months, compared to 30 percent since 2018.

What’s going on?

Boomerang hires surged during the summer of 2020 as companies scrambled to rehire workers that had been laid off during the pandemic shutdown that spring.

The great resignation of 2022 was another time of peak labor market churn, as workers in unprecedented numbers voluntarily left their jobs. In March 2022, quits hit a record high. Wage growth for job-switchers skyrocketed, as employers lured workers with lucrative compensation packages. During this time, boomerang employees as a share of new hires fell to a March low of 26 percent.

That trend has now reversed. Quits have dropped by more than 25 percent from their March 2022 peak, and boomerang rehiring has been rising.

My take

There are several reasons employers might be eager to rehire former employees. In the case of the information sector, for example, a worker with the right skill set can be difficult to find. Certain skills might be geographically concentrated, for example, which makes luring back former employees one good way to obtain needed expertise.

Boomerang employees can be easier to onboard and more prepared to hit the ground running. This ability could be highly sought after by employers looking to make efficiency gains as the economy slows and the threat of higher prices increases.

Returning employees, particularly those lured to new organizations during and after the pandemic, might have learned that the grass wasn’t greener at their new job. Moreover, lower U.S. rates of residential mobility suggest that workers today are less inclined to move for new opportunities, which limits their options.

For both workers and employers, elevated economic uncertainty might be inspiring a return to familiar relationships.

While all these explanations are plausible, they suggest that both job-switching and hiring have become more cautious now than in the last four years.

How you leave a job matters more in today’s labor market, because you might be back.

The week ahead

Thursday: The National Association of Realtors will release existing home sales for April. In March, existing sales fell 2.4 percent year over year. And the recent downgrade of U.S. credit by Moody’s Ratings could trigger higher mortgage rates, adding another headwind to already low inventory, historically low household mobility, and affordability constraints. The good news? Housing wealth continues to soar.

Initial jobless claims have been unmoved despite bond markets and weak consumer sentiment pointing to a worsening economic outlook. Initial claims published Thursday by the Department of Labor are likely to remain near record lows, which suggests that the labor market remains solid.

Friday: The Census Bureau will release April data on new home sales, which have been strong so far this year thanks to overall inventory shortages. New home sales, which account for about 14 percent of the total housing market, were up 6 percent in March from a year earlier. But with housing starts starting to slump under the weight of higher mortgage rates and increased costs for materials such as aluminum and lumber, we’ll find out soon if the surge in new home sales can continue.