A silver twist on the gig economy

November 25, 2025

|

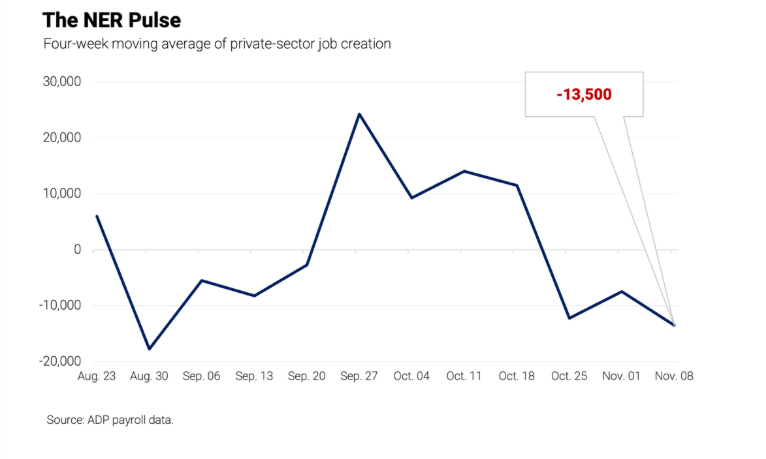

The NER Pulse

For the four weeks ending Nov. 8, 2025, private employers shed an average of 13,500 jobs a week. Consumer strength remains in question as we enter the holiday hiring season, which might be playing into delayed or curtailed job creation.

These numbers are preliminary and could change as new data is added.

A silver twist on the gig economy

The federal government’s delayed September employment report, released last week, showed that the economy added 119,000 jobs that month, better than economists had predicted.

But for self-employed workers, the news wasn’t as good. The gig economy lost 114,000 jobs that month. In fact, the ranks of self-employed workers have been declining all year. As of September, U.S. gig employment was down 1.2 percent from a year ago.

A new ADP Research report suggests that structural demographic change is on track to reverse this short-term downward trend. We believe that self-employment is poised to become an important share of job gains over time.

Trends in self-employment

Self-employment is the broad IRS descriptor for people who work outside the conventional employer-employee system we’re all familiar with. Gig work is a type of self-employment that tends to be app-based and temporary.

The rate of self-employment has been slowing for the past two decades, and stood at 5.7 percent in 2023, the most recent estimate available from the Bureau of Labor Statistics. Historically, people who are middle-age and older have always made up a disproportionate share of self-employed workers. That remains true today.

Before 1970, agriculture accounted for a large share of the self-employed workforce. As independent work on family farms declined, the share of self-employed workers fell. By the 1970s, agriculture’s share of self-employed workers had settled into a historic low level as non-traditional employment grew in other industries.

These independent work arrangements peaked in the spring of 2005, then fell during the pandemic, as did traditional employment. Since then, self-employment has stabilized near its pre-pandemic level.

A two-tiered economy

In our latest report, The gig economy: A tale of two labor markets, we look at self-employed workers in two distinct and very different categories, short-term employees and 1099 independent contractors.

Short-term W-2 employees—people who worked for an employer for less than six months—represented 21.8 percent of all workers who were paid during 2024. The corresponding share of 1099 contractors was 2.5 percent.

Though temporary workers made up the bulk of gig employment, our analysis of anonymized and aggregated ADP payroll data showed that independent contractors make up a growing share of the self-employed. The monthly count of independent contractors rose from 300,000 in 2019 to 450,000 in 2024, a 50 percent increase.

Our analysis also showed that independent contractors are far more prevalent in higher-paid professions and sectors where advanced education and expertise are needed.

Demographic divides

These differences in pay and skills point to an important demographic divide in the gig economy. Temp workers skew young, contractors skew old.

More than 43 percent of temp workers were younger than 30 in 2024. That same year, 7.2 percent of independent contractors were 70 and older, compared to 3.8 percent of the overall workforce.

Recent academic research has shown that self-employment, predominantly in the form of independent contract work in occupations requiring a high level of expertise, is more prevalent for workers 50 and older.

My take

The definition of self-employment continues to evolve. From its largely agricultural base on family farms in the 1940s to today’s freelancers offering app- and platform-based services, self-employment has had several transformations.

It’s now on the verge of a new change, one driven by our aging workforce. In the United States, more than 10,000 people turn 65 every day. In the next 20 years, people 65 and older will make up nearly 20 percent of the U.S. population. And they’re living longer in retirement, too.

Many of these older people might be working to supplement their retirement income. Others might stay connected to the labor market because they enjoy their work and the social connection it delivers.

Whatever their reasons for staying in the labor market, technology and the economy’s recent embrace of remote work have made it easier than ever for these people to stay connected to work in advanced age.

But with the silvering of the U.S. workforce, these older independent contractors have grown increasingly important to employers. As more workers retire, they take their expertise and institutional knowledge with them. Employer demand has given these skills and deep experience a second life in the gig economy.

The week ahead

Tuesday: Government data releases continue to play catch-up this week after the record-long federal shutdown. Census Bureau retail sales data for September will give economists a rearview look at consumer resilience. We also will see September producer prices, a measure of inflation faced by manufacturers that tend to lead price increases consumers face.

The S&P Cotality Case-Shiller home price index also will be in focus today after rising home prices pushed home equity wealth to a record high earlier this year. Despite rising asset values, consumer confidence has been downbeat. The Conference Boad will deliver its Consumer Confidence Index for November, giving us a fresh read on sentiment as the holiday shopping season kicks off.

Wednesday: The Census Bureau will release its delayed September report on orders for durable goods. Spending on big-ticket items such as cars, appliances and TVs are a harbinger of economic growth and an important pace-setter for the year-end shopping season.

The Department of Labor’s weekly initial jobless claims report will arrive a day early due to the Thanksgiving holiday. Initial claims of late have been stable near historical lows, but continuing claims continue to edge up. Last week, continued claims hit their highest level in four years, a move driven partly by federal employees.

A reminder, there will be no NER pulse next Tuesday. Instead, we’ll release the monthly ADP National Employment Report for November on Wednesday. Happy Thanksgiving!