Small business startups: The beat goes on. Or does it?

April 15, 2025

While market volatility dominated the headlines last week, small businesses quietly hit a milestone. Applications for new startups reached their second-highest level on record.

Small businesses have long served as the backbone of U.S. employment. During the economic expansion that preceded the 2020 pandemic—at more than 10 years, it was the longest period of growth in U.S. history—small businesses created almost two-thirds of all new jobs.

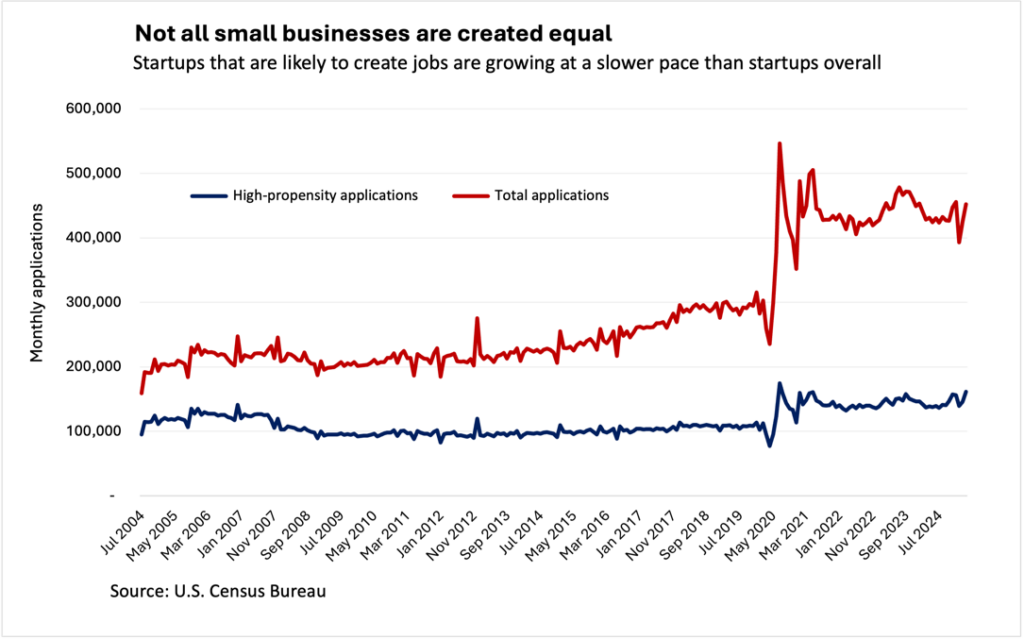

During our current expansion, new business applications have soared, raising hopes that small businesses can continue to carry the torch for job creation. But as we’ll see, not all small businesses are created equal, especially in today’s gig-heavy economy. Small business formation isn’t what it used to be.

The rise of small businesses

In the five years leading up to the pandemic, applications for employer identification numbers averaged 271,616 a month, according to Census Bureau data. Since March 2020, when the brief pandemic recession began, that average soared to 430,495 a month, a nearly 60 percent increase.

And this growth shows no sign of ending any time soon. In March, entrepreneurs submitted more than 452,000 new business applications, up nearly 5.6 percent from a year earlier.

Gig workers versus job creators

As we mentioned, not all new businesses are created equal. Most start as one-person operations with little or no intent to hire employees. Sole proprietorships and many gig workers fall into this category.

But an important subset of new business filings, called high-propensity business applications, explicitly express an intent to hire and establish payrolls.

Applications from these potential job creators have risen over the last several years. In fact, the number of high-propensity applications hit their second-highest level on record in March, up 18 percent from a year earlier.

This growth doesn’t tell the whole story, however. Though high-propensity applications are up from two decades ago, their share of total business applications has fallen from 58 percent in March 2005 to 36 percent in March 2025. Since spring 2020, the share of high-propensity applications has made up about a third of total applications.

And within the category of high-propensity applications, there is an even more select subset: business applications with planned wages. Because these filings include a wage pay date, Census gives them a high likelihood of transitioning into a business with workers on a payroll.

These applications, too, tell a complex story. In March, 44,274 applications included planned wages, about 10 percent of total applications. But this category shrank 3.8 percent from a year earlier and has posted negative year-over-year growth on a monthly basis for 15 consecutive months dating back to January 2024.

My take

Demographic changes, financial conditions, technological innovation, and the rise of the gig economy have given a collective boost to America’s entrepreneurial drive.

As more workers reach retirement age, they’re able to leverage their experience into new kinds of employment. And many young adults are opting out of the traditional employer-employee relationship to become business owners themselves.

Near-record-high home equity and long-term financial market gains have given these Main Street entrepreneurs the dry powder to launch new businesses.

The economic stakes are high. As recently as 2022, enterprises with fewer than 500 people employed 46 percent of the U.S. workforce, Census data shows.

So, while business applications are higher than ever, the lion’s share of these startups aren’t likely to be the job creators the economy needs.

The week ahead

Tuesday: Consumer sentiment is at historic lows, but how are workers feeling? The ADP Research Employee Motivation and Commitment Index tracks how people think and feel about their jobs and employer.

Wednesday: Retailers forecast solid growth in 2025, a prediction that so far has proven accurate, despite heightened consumer jitters. Retail data from the Census Bureau will show whether consumer spending remained strong in March.

Thursday: Census data on housing starts and residential building permits will reflect activity for March. As such, it’s not likely to tell us much about the impact of tariffs on residential construction. The most recent Producer Price Index was good news to the industry, showing only modest price increases on building materials so far.

Weekly initial jobless claims, a proxy for layoffs, have hovered near historic lows for the past two years and are one of the most reliable indicators of labor market health. Continued stability would help calm layoff fears.